Uji Event Studies: Dampak Peristiwa Aksi Bela Islam (Aksi 212) Terhadap Abnormal Return dan Trading Volume Activity (Saham Syariah di Jakarta Islamic Index)

Abstract

This article is intended to test the theory of market efficiency hypotheses in weak forms through event studies. Empirical testing in the form of investor response to the massive Muslim demonstration over alleged blasphemy known as action 212. Investors' response testing, in the form of whether the 212 action affects the volatility of abnormal returns and the trading volume of shari'ah stock activity incorporated in Jakarta Islamic Index. The research data are secondary, namely stock returns, stock prices, stock price indexes and sharia stock abnormal returns, with an observation period of 15 days around the date of the action event 212. Data collection by documentation procedures. The number of companies included in the analysis are 26 companies. Data were analyzed using Paired Sample t-Test statistics. The results of testing the hypothesis with empirical data show that the first hypothesis that there are differences in the average abnormal return before and after the 212 action is significantly accepted. Meanwhile, the second hypothesis that there are differences in average trading volume activity before and after the 212 action does not significant (rejected). The results of testing the hypothesis indicate that investors respond to 212 actions in the form of stock price volatility so that abnormal returns are significantly different after and before the 212 action. The response form is also indicated by a wait and see attitude, so that active trading around the 212 action date and after 212 action tends decrease or stagnate.

Keywords

Full Text:

PDFReferences

DAFTAR PUSTAKA

Anisah, Nur, Lilik Pujiati dan Dian Sulistyo Widarti, 2017, Pengaruh Perubahan Harga Bahan Bakar Minyak terhadap Investasi Saham Perusahaan Transportasi Darat, EKSIS, Vol. 12, No.1.

Annisa Susanti, 2015, Analisis Pengaruh Kemenangan Pasangan Joko Widodo-Jusuf Kalla dalam Pilpres 2014 terhadap Abnormal Return dan Trading Volume Activity pada Kelompok Saham Indeks LQ-45, Skripsi, Universitas Negeri Yogyakarta,Un-publised.

Antariksa, B. 2005. Fenomena The Monday Effectdi Bursa Efek Jakarta. Simposium NasionalAkuntansi VII. Solo

Ambarwati. Sri Dwi Ari, 2005, Pengujian Eeek-Four, Monday, Fiday, dan Earning Mnagement Effect terhadap Return Saham, Jurnal Keuangan dan Perbankkan, Vol 13, No. 1.

Artiza Brilian Sari, 2011, Pengaruh Stock Split Terhadap Abnormal Return Dan Trading Volume Activity Pada Perusahaan Yang Terdafar Di Bursa Efek Indonesia, Skripsi, Universitas Negeri Semarang,-un-pubished, 74.

Aktas, H. and Oncu, S., 2006, The stock market reaction to extreme events: the evidence from Turkey, International Research Journal of Finance and Economics, Vol. 6, No. 6, pp. 78-85.

Bayuwati, Endah, 2010, Reaksi Return Perusahaan PMA dan PMDN terhadap Pengumuman Hasil Pemilu Legislatif, Pengumuman Hasil Pemilu Presiden dan Wakil Presiden, serta Pengumuman Hasil Pembentukan Kabinet 2009 (Studi pada Perusahaaan yang Terdaftar di BEI, Skripsi, Universitas Sebelas Maret Surakarta, uh-publised

Bodie, Zvi, Alex Kane, dan Alan J. Marcus, 2014, Manajemen Portofolio dan Investasi. Terjemahan oleh Romi Bhakti Hartarto dan Zuliani Dalimunthe, Jakarta: Salemba Empat.

Brown, S. and Warner, J., 1985, Using daily stock returns in event studies, Journal of Financial Economics, Vol. 14, No. 1, pp. 3-31.

Bechtel, M.M., 2009, The political sources of systematic investment risk: lessons from a consensus democracy, The Journal of Politics, Vol. 71, No. 2, pp. 661-677.

Christianus Sigit, 2017, Seri Belajar Kilat SPSS 18, Yogyakarta, Andi, 70.

Cahyaningdyah, D, 2005, Analisis Pengaruh Hari Perdagangan Terhadap Return Saham: Pengujian Week-Four Effect dan RogalskiEffect di Bursa Efek Jakarta, Jurnal Ekonomidan Bisnis Indonesia, Vol.20, No.2, hal.175-186.

Chiu, C.L., Chen, C.D. and Tang, W.W., 2005, Political elections and foreign investor trading in South Korea’s financial markets, Applied Economics Letters, Vol. 12 No. 11, pp. 673-677.

Dyl, Edward A, Maberly, Edwin D, 1988, A Possible Eplantion of The Weeken Effect, Financial Analysis Journal, Vol. 44, No. 33.

Djoko Susanto & Agus Sabardi, 2010, Analisis Teknikal Di Bursa Efek Edisi Kedua, Yogyakarta, UPP STIM YKPN, 41.

Fabozzi, Frank J., 1999, Manajemen Investasi, Terjemahan oleh Tim Salemba Empat, Jakarta, Salemba Empat.

Fahmi, Irham, 2015, Manajemen Investasi Teori dan Soal Tanya Jawab Edisi 2. Jakarta: Salemba Empat.

Fiton, Moch Khusnul, 2015, Analisis Pengaruh Pelantikan Kabinet Kerja Presiden Joko Widodo pada 27 Oktober 2014 terhadap Reaksi Pasar Saham (Studi Kasus pada Saham yang Terdaftar LQ 45 di BEI, Skripsi, Universitas Malik Ibrahim Malang, Un-publised.

Ferguson, N., 2006, Political risk and the international bond market between the 1848 revolution and the outbreak of the First World War, Economic History Review, Vol. 59, No. 1, pp. 70-112

Feils, D.A., 2000, The impact of political risk on the foreign direct investment decision: a capital budgeting analysis, Emerging Economist, Vol. 45, No. 2, pp. 129-143.

Fransisko Purba & Siti Ragil Handayani, 2017, Analisis Perbedaan Reaksi Pasar Modal Indonesia Sebelum Dan Sesudah Peristiwa Non Ekonomi (Studi Pada Peristiwa Politik Pilkada DKI Jakarta 2017 Putaran Kedua), Jurnal Administrasi Bisnis, Vol. 51, No. 1. pp. 115.

Ghozali, Imam, 2011, Aplikasi Analisis Multivariate dengan Program IBM SPSS 19 Edisi 5, Semarang, Badan Penerbit Universitas Diponegoro.

Hadi, Nor, 2015, Pasar Modal. Yogyakarta, Graha Ilmu.

Halim, Abdul, 2005, Analisis Investasi, Jakarta, Salemba Empat.

Halim, Abdul. 2015. Analisis Investasi dan Aplikasinya, Jakarta, Salemba Empat.

Hartono, Jogiyanto, 2004, Metodologi Penelitian Bisnis; Salah Kaprah dan Pengalaman-pengalaman. Yogyakarta, BPFE, 667.

Husnan, Suad, 2003, Dasar-dasar Teori Portofolio dan Analisis Sekuritas, Yogyakarta, AMP YKPN.

Hidayat. R. Rustam. 2016. Pengarug Fakator-faktor Teknikal Tethadap Harga Saham Studi pada Hrga Saham IDX 30 di Bursa Efek Indonesia Periode 2012-2015, Jurnal Administrasi Bisnis Vol. 37, No. 1.

Hari Prasetyo, 2006, Analisis Pengaruh Hari Perdagangan Terhadap Return, Anbormal Return, Dan Volatilitas Return Saham (Studi Pada LQ 45 Periode Januari–Desember 2005), Tesis, Universitas Diponegoro, Un-plusished, 33

I Made Deva Hasdwi Putra & I Gusti Ayu Made Asri Dwija Putri, 2018, Analisis Reaksi Pasar Sebelum dan Sesudah Pengumuman Kemenangan Donald Trump Menjadi Presiden Amerika Serikat”, E-Jurnal Akuntansi Universitas Udayana, Vol. 23, No. 1, Pp. 430, diakses pada 3 Desember, 2018, https://doi.org/10.24843/EJA.2018.v23.i01.p16.

Irmayani, Ni Wayan Dian ,dan Ni Luh Putu Wiagustini, 2015, Dampak Stock Split terhadap Reaksi Pasar pada Perusahaan yang Terdaftar di Bursa Efek Indonesia, E-Jurnal Manajemen Unsoed 4, No. 10, (2015) – 26 September, 2018 - https://ojs.unud.ac.id/index.php/Manajemen/article/view/14576.

Ismail, I. and Suhardjo, H., 2001, The impact of Domestic political events on an emerging stock market: the case of Indonesia, Proceedings of Asia Pacific Management Conference, pp. 235-262.

Jorion, P. and Geotzmann, W.N., 1999, Global stock markets in the twentieth century, Journal of Finance, Vol. 54, No. 3, pp. 953-980.

Katti, Siri Wardani Bakri, 2018, Pengaruh Peristiwa Politik (Pemilu Presiden dan Pengumuman Susunan Kabinet) terhadap Saham Sektor Industri di Bursa Efek Indonesia, CAPITAL, Vol. 1, No. 2.

Lestari, Dyah Putri Fuji, 2018, Dampak Britain Exit (DREAXIT) terhadap Abnormal Return dan Trading Volume Activity pada Indeks LQ-45, Jurnal Administrasi Bisnis (JAB) 55, No. 3, 2018.

Murtini, U. & Halomoan.A.I. 2007. Pengaruh HariPerdagangan terhadap Return Saham:Pengujian Monday, Week-Four, danRogalski Effect di Bursa Efek Jakarta, Jurnal Riset Akuntansi dan Keuangan, Vol.3, No.1, hal.20-33.

Miller, 1988, The Modigliani-Miller Propositions after Thirty Years, Journal of Economic Perspective, Vol. 2, No. 4, pp.99-120.

Mian Sajid Nazir, Hassan Younus, Ahmad Kaleem & Zeshan Anwar, 2014, Impact of political events on stock market returns: empirical evidence from Pakistan, Journal of Economic and Administrative Sciences, Vol. 30, No. 1, pp. 60-78.

Masood, O. and Sergi, B.S., 2008, How political risks and events have influenced Pakistan’s stock markets from 1947 to present, Economic Policy in Emerging Economies, Vol. 1, No. 4, pp. 427-444.

Mackinlay, A., 1997, Event studies in economics and finance, Journal of Economics Literature, Vol. 35, No. 1, pp. 13-35

Moch Khusnul Fiton, 2014, Analisis Penngaruh Pelantikan Kabinet Kerja Presiden Joko Widodo Pada 27 Oktober 2014 Terhadap Reaksi Pasar Saham (Studi Kasus Pada Saham Yang Terdaftar LQ 45 di BEI), Skripsi, Universitas Malik Ibrahim Malang, Un-publised, 43.

Prasetyo, Hari, 2006, Analisis Pengaruh Hari Perdagangan terhadap Return, Abormal Return, Dan Volatilitas Return Saham (Studi pada LQ 45 Periode Januari – Desember 2005), Tesis, Universitas Diponegoro, un-pubised

Pratama, I Gede Bhakti, Ni Kadek Sinarwati dan Nyoman Ari Surya Dharmawan, 2018, “Reaksi Pasar Modal terhadap Peristiwa Politik (Event Studies pada Peristiwa Pelantikan Joko Widodo Sebagai Presiden Republik Indonesia Ke-7)”, e-Journal S1 Ak Universitas Pendidikan Ganesha, Vol. 3, No. 1, 2015 - 28 September, 2018, https://ejournal.undiksha.ac.id/index.php/S1ak/article/ view/4754.

Peter, S., 2015, Explaining Short Run Performance of Initial Public Offerings in an Emerging Frontier Market: Case of Sri Lanka, International Journal of Economics, Business and Finance, Vol. 3, No. 1, pp 1–13.

Perera, W., & Kulendran, N., 2016, Evaluation of Short-Run Market Performance and its Determinants Using Marginal Analysis and Binary Models: Evidence from Australian Initial Public Offerings, Journal of Insurance and Financia Management, Vol. 2, No. 6, pp. 1–29.

Qian Sun, Wison. H. S. Tong, Jing Tong, 2003, How Daes Government Ownership Affect Firm Performance? Evidence from China’s Privatizations Experience, Journal of Business & Accounting, Vol. 29, No. 1-2, pp. 1-27.

Rahmawati, Ika Yustina, 2016, Reaksi Pasar Modal dari Dampak Peristiwa Bom Plaza Sarinah terhadap Abnormal Return Perusahaan LQ 45 yang Terdaftar di BEI, Riset Akuntansi dan Keuangan Indonesia, vol.1, No. 2.

Santoso, Heri dan Luh Gede Sri Artini, 2015, Reaksi Pasar Modal Indonesia terhadap Pemilu Legislatif 2014 pada Indeks LQ45 DI BEI, E-Jurnal Manajemen Unud 4, No. 9, 2015 - 2 Desember, 2018 - https://ojs.unud.ac.id/index.php/Manajemen/article/view/13566.

Sari, Artiza Brilian, 2011, Pengaruh Stock Split terhadap Abnormal Return dan Trading Volume Activity pada Perusahaan yang Terdaftar di Bursa Efek Indonesia, Skripsi, Universitas Negeri Semarang, uh-publise.

Sigit, Christianus, 2017, Seri Belajar Kilat SPSS 18, Yogyakarta, Andi.

Sulistiawan, Dedhy dan Liliani, 2007, Analisis Teknikal Modern pada Perdagangan Sekuritas, Yogyakarta, Andi.

Suryawijaya, Marwan Asri, dan Faizal Arief Setiawan, 1998, Reaksi Pasar Modal terhadap Peristiwa Politik dalam Negeri (Event Studies pada Peristiwa 27 Juli 1996), KELOLA, Vol. VII, No. 18.

Setiyo, I & Nurhatmini, E., 2003, Pengaruh Hari Perdagangan dan Exchange Rate terhadapReturn Saham di BEI, Jurnal Wahana, Vol.6, No.1.

Tandelilin, Eduardus, 2010, Portofolio & Investasi Teori dan Aplikasi Edisi Pertama, Yogyakarta, Kanisius IKAPI.

Vong, A. P. I., & Trigueiros, D., 2010, The short-run price performance of initial public offerings in Hong Kong: New evidence, Global Finance Journal, Vol. 21, No. 3, pp 253–261.

Yanti, Firga, 2012, Pengujian Abnormal Return Saham Sebelum dan Sesudah Peluncuran Indeks Saham Syariah Indonesia (ISSI), Jurnal Manajemen. Vol. 01, No. 01.

DOI: http://dx.doi.org/10.31942/iq.v7i1.3444

Refbacks

- There are currently no refbacks.

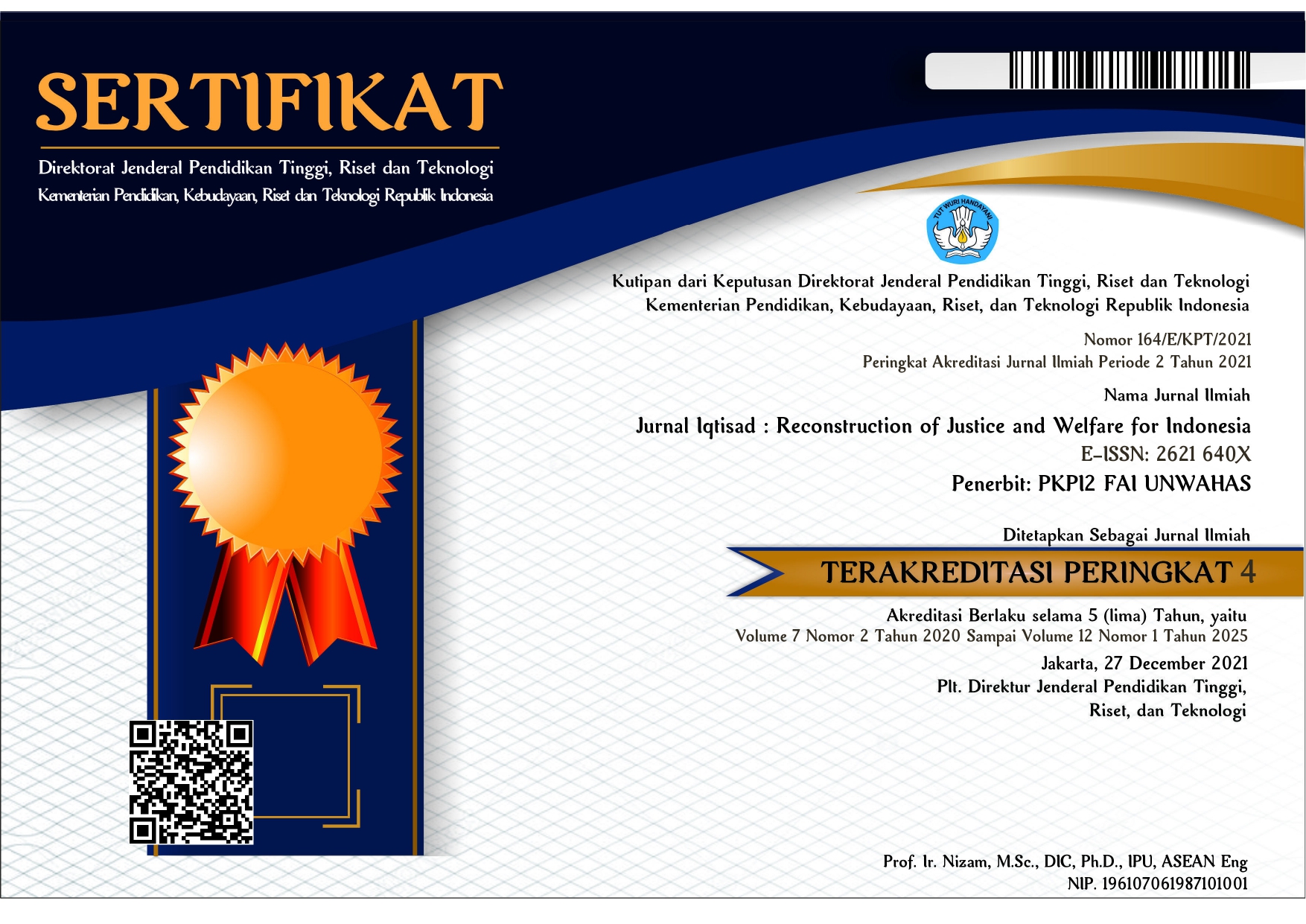

JURNAL IQTISAD: Reconstruction of Justice and Welfare for Indonesia is INDEXED BY:

Alamat kami di :

PKPI2 FAI Universitas Wahid Hasyim